The original article Archived Message

Posted by Riverbender  on July 23, 2019, 7:17 am, in reply to "Re: Raising Property Taxes To Fund Affordable Housing" on July 23, 2019, 7:17 am, in reply to "Re: Raising Property Taxes To Fund Affordable Housing"

Authored by Mark Glennon via WirePoints.org,

Property taxes will go up to pay for affordable housing if legislation now pending in the General Assembly passes. It’s not styled as a property tax increase, but that’s exactly what it is. It’s styled as property tax caps or reductions for affordable housing, which would directly result in increases for homeowners and everybody else.

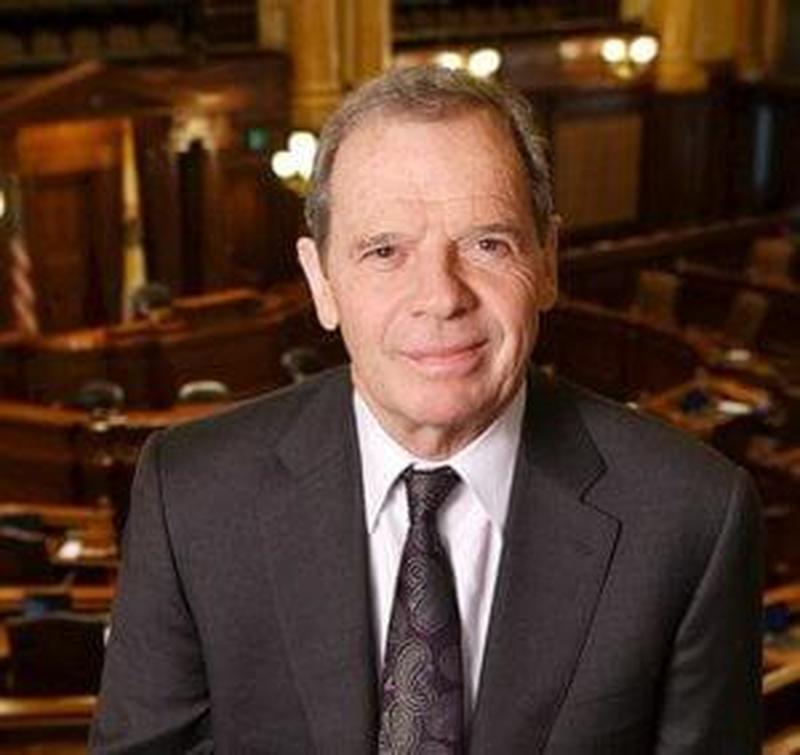

Two bills are pending. The first is Senate Bill 2259, sponsored by Senate President John Cullerton (D-Chicago). It would artificially limit increases in assessments of new or rehabilitated apartment complexes if the owner commits at least 20 percent of the building’s units to a rent cap for families that make less than a set income depending on the area. The second, House Bill 2168, goes further and would directly reduce assessments on similarly defined affordable apartments. It has nine House sponsors.

In other words, both bills would give a property tax break to owners of apartments for lower income renters. The problem is that the levy – the total amounts collected by each taxing authority – wouldn’t change. That means all other property owners pay the difference. The end result is simple and undeniable: Property owners would fund a special subsidy for affordable housing.

You’d think lawmakers had learned their lesson. In 2017, Chicago wanted a way to soften the blow of the city’s property tax increases, or at least make them look softer. Singling out the city wasn’t workable, so it got Springfield to pass increases in the homestead and senior exemptions for all of Cook County. We wrote about the dismal results for other taxpayers here, which the Chicago Tribune detailed. Other property owners got clobbered, especially in lower income areas.

As the Tribune reported on those results, “Many, many people are saying it’s not financially beneficial for them to pay the taxes they pay on their homes, when every 11 to 13 years, they’re paying the total costs of their home in taxes,” said Harvey Ald. Keith Price, economic development committee chairman.

“I’ve talked to a couple of people that have personally told me that they are not paying their taxes anymore. They’re going to save their money, and within the two years they have (before they lose the house), they’ll just save all their money and leave.”

It has only worsened since then.

If Illinois wants to pay for affordable housing it should be done smartly. The simplest and most efficient means to provide housing assistance is vouchers, not convoluted incentives like Springfield is moving towards. The pending bills would require a whole new level of bureaucracy for assessors and administrators to enforce.

The pending bills have other major flaws. Projects that would have been built anyway will still get the tax break. On them, the subsidy will have been wasted. And there’s no way to measure results. How will we know how many new projects, if any, get built thanks to the tax incentive? We won’t. That’s unknowable. For that same reason, we won’t know the full cost until after the fact.

Most importantly, property taxes are the last place to look to for funding. Illinois rates are already neck and neck with New Jersey’s for the highest in the nation. Hundreds of thousands of Illinois homeowners have had their equity erased or worse, been trapped with underwater mortgages. Suppressed values, primarily because of those taxes, have already cost Illinois homeowners a quarter trillion dollars just in the last ten years.

|

|